Mumbai: India is proving to be a tough market to navigate for global automakers, with the exception of some Japanese and Korean car companies. To find traction in this market, the third largest in the world with plenty of room for growth, some of these automakers are exploring options that include partnerships with Indian business houses, which may be operating in a different industry but can provide support to navigate policy uncertainties and market insights. They already have a template in the MG Motor-JSW Group joint venture.

Big American automakers General Motors and Ford have left India after failing to build a sustainable business here. Meanwhile, foreign companies that have built local joint ventures, such as Skoda-Volkswagen and Renault-Nissan, have yet to find sustained success in the Indian market, even after decades of presence and product renewals here.

As the market tightens and technology and consumer preferences shift rapidly, industry executives and analysts said some of these companies, as well as new entrants like Vietnam’s VinFast and Chinese automakers BYD, Geely and Chery, are considering local partnerships. “India is no longer an easy market to read,” said an auto analyst with a leading brokerage. “Demand has become fragmented, regulations keep evolving and competition is cutthroat. Companies without scale or deep local understanding find it hard to sustain distribution and after-sales support. Partnering with an Indian player may be the only viable way to stay relevant.”

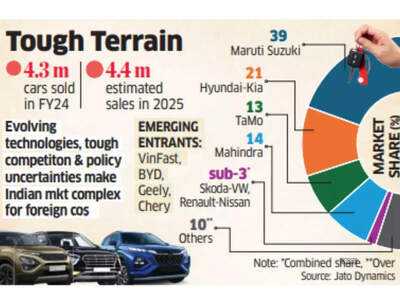

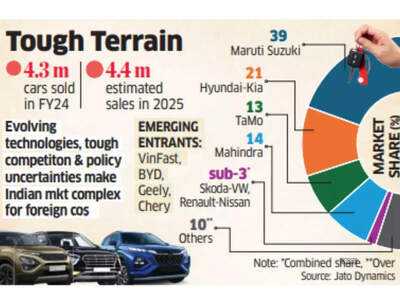

Global automakers have long viewed India as a market of promise — high growth potential, a large young population and increasing incomes. But turning that promise into profitability has proved elusive for most. The Renault-Nissan alliance, once buoyed by models like the Kwid and Duster, has seen its market share erode. The Skoda-Volkswagen group’s ‘India 2.0’ project has brought new products like the Kushaq and Slavia, yet volumes remain modest in a market that sold nearly 4.3 million cars and utility vehicles in 2024.

Unlike Japan’s Maruti Suzuki, Korea’s Hyundai and Kia, or homegrown players Tata Motors and Mahindra & Mahindra, most global automakers have yet to fully decode the Indian buyer’s mix of value, reliability and affordability. Japan’s Toyota Motor, which has a local minority partner in Kirloskar, and Honda have seen success in certain segments. “Hyundai and Kia have a strong local supply base, India-first product strategy, and aggressive market positioning. The two Korean brands now account for over a quarter of all passenger vehicle sales," said a Mumbai-based analyst. "That’s why India is now their growth engine globally."

Companies like Maruti Suzuki, Tata and Mahindra have invested for the long haul and built strong supplier and dealer networks. Several global automakers have been hesitant or underinvested in these areas. Having a local partner could matter in these circumstances. For several global brands, the missing piece has been a dependable local ally, said industry experts. Beyond capital, such a partner can provide policy assurance, local market knowledge and help understand regulatory complexities — especially critical for companies from geopolitically sensitive regions such as China. “A domestic partner can lend credibility and continuity, particularly when regulatory frameworks are unpredictable,” said a senior executive of a car company. “It can also improve after-sales reach and dealer confidence, areas where most foreign OEMs lag due to low volumes.”

Chinese-owned British brand MG Motor tied up with Sajjan Jindal’s JSW Group after it found bringing foreign investment to scale up difficult amid worsening India-China relations. JSW bought a 35% stake in MG Motor India from China’s SAIC Motor in late 2023, which has helped the brand gain local credibility, expansion headroom and policy comfort. French automaker Renault is reportedly in early discussions with the JSW Group for a potential joint venture in India, as it seeks to strengthen its India presence. Its market share in India remains less than 1%.

JSW Motors, the SAIC-JSW Group joint venture, is also in talks with other automakers like BYD and Skoda VW for technology and platform access, as it actively seeks new partnerships to expand its presence in the electric mobility segment. Chery Automobile will provide components to the JSW Group, facilitating the launch of a new-energy vehicle brand in India by 2027. “We will have collaborations to draw upon the unique strengths of industry-leading partners from around the world like sourcing proven EV and battery technologies from China, design and safety excellence from Europe, software and connectivity from the US, and combining them with India’s manufacturing strength and digital agility,” said JSW Motors chief executive Ranjan Nayak.

Vietnamese electric vehicle manufacturer VinFast, meanwhile, said it is always open to collaborating with potential strategic partners in India. “Several experienced local suppliers have already reached out to us with partnership proposals, which we are currently reviewing," said its India CEO Tapan Kumar Ghosh. A spokesperson for Skoda Auto Volkswagen India said India is a key market in Škoda Auto’s internationalisation plans. “To fully explore the country’s growth potential, we are always considering new business opportunities and are evaluating various options to ensure the best possible solution to implement our strategy in the highly dynamic Indian market.” Skoda Auto Volkswagen India and Mahindra had explored a partnership, but the talks have now stalled. Companies such as Renault and Geely did not comment on potential plans for a partnership. Industry sources said exploratory talks were taking place quietly.

To achieve sustainable growth, automakers in India must collaborate and form strategic partnerships, said Kavan Mukhtyar, leader automotive at PwC India. “With technology becoming increasingly disruptive, the need for significant investment and profitable expansion is driving automakers to actively explore alliances and joint ventures,” he said. Ravi Bhatia, president of automobile consultancy Jato Dynamics, said local support will help foreign automakers scale operations as well as cut costs. “Renault with its underutilised Chennai plant (33% capacity) boasts modular architecture, but needs partners to scale exports and leverage India's 50% localisation mandates for duty cuts,” he said. “Strategic partnerships could bridge gaps, cutting EV costs by 15-20%.”

However, experts caution that local tie-ups are no guarantee of success. Past alliances such as Mahindra-Ford and Premier Automobiles-Peugeot underscore the risks of mismatched strategies and governance issues. “Partnerships only work when both sides bring more than money; they need long-term commitment and strategic alignment,” said an auto industry veteran. “Many earlier JVs failed because the foreign partner saw India as an export base, not a domestic growth story.”

For now, several global automakers are leaning on exports from their Indian plants to stay viable, even as their domestic market share remains marginal. With India’s position in the global automobile market continuing to grow, analysts believe localisation in manufacturing, products and management will determine who thrives. “India rewards long-term commitment,” said an analyst. “Without it, even the biggest global brands will remain on the fringes.”

Big American automakers General Motors and Ford have left India after failing to build a sustainable business here. Meanwhile, foreign companies that have built local joint ventures, such as Skoda-Volkswagen and Renault-Nissan, have yet to find sustained success in the Indian market, even after decades of presence and product renewals here.

As the market tightens and technology and consumer preferences shift rapidly, industry executives and analysts said some of these companies, as well as new entrants like Vietnam’s VinFast and Chinese automakers BYD, Geely and Chery, are considering local partnerships. “India is no longer an easy market to read,” said an auto analyst with a leading brokerage. “Demand has become fragmented, regulations keep evolving and competition is cutthroat. Companies without scale or deep local understanding find it hard to sustain distribution and after-sales support. Partnering with an Indian player may be the only viable way to stay relevant.”

Global automakers have long viewed India as a market of promise — high growth potential, a large young population and increasing incomes. But turning that promise into profitability has proved elusive for most. The Renault-Nissan alliance, once buoyed by models like the Kwid and Duster, has seen its market share erode. The Skoda-Volkswagen group’s ‘India 2.0’ project has brought new products like the Kushaq and Slavia, yet volumes remain modest in a market that sold nearly 4.3 million cars and utility vehicles in 2024.

Unlike Japan’s Maruti Suzuki, Korea’s Hyundai and Kia, or homegrown players Tata Motors and Mahindra & Mahindra, most global automakers have yet to fully decode the Indian buyer’s mix of value, reliability and affordability. Japan’s Toyota Motor, which has a local minority partner in Kirloskar, and Honda have seen success in certain segments. “Hyundai and Kia have a strong local supply base, India-first product strategy, and aggressive market positioning. The two Korean brands now account for over a quarter of all passenger vehicle sales," said a Mumbai-based analyst. "That’s why India is now their growth engine globally."

Companies like Maruti Suzuki, Tata and Mahindra have invested for the long haul and built strong supplier and dealer networks. Several global automakers have been hesitant or underinvested in these areas. Having a local partner could matter in these circumstances. For several global brands, the missing piece has been a dependable local ally, said industry experts. Beyond capital, such a partner can provide policy assurance, local market knowledge and help understand regulatory complexities — especially critical for companies from geopolitically sensitive regions such as China. “A domestic partner can lend credibility and continuity, particularly when regulatory frameworks are unpredictable,” said a senior executive of a car company. “It can also improve after-sales reach and dealer confidence, areas where most foreign OEMs lag due to low volumes.”

Chinese-owned British brand MG Motor tied up with Sajjan Jindal’s JSW Group after it found bringing foreign investment to scale up difficult amid worsening India-China relations. JSW bought a 35% stake in MG Motor India from China’s SAIC Motor in late 2023, which has helped the brand gain local credibility, expansion headroom and policy comfort. French automaker Renault is reportedly in early discussions with the JSW Group for a potential joint venture in India, as it seeks to strengthen its India presence. Its market share in India remains less than 1%.

JSW Motors, the SAIC-JSW Group joint venture, is also in talks with other automakers like BYD and Skoda VW for technology and platform access, as it actively seeks new partnerships to expand its presence in the electric mobility segment. Chery Automobile will provide components to the JSW Group, facilitating the launch of a new-energy vehicle brand in India by 2027. “We will have collaborations to draw upon the unique strengths of industry-leading partners from around the world like sourcing proven EV and battery technologies from China, design and safety excellence from Europe, software and connectivity from the US, and combining them with India’s manufacturing strength and digital agility,” said JSW Motors chief executive Ranjan Nayak.

Vietnamese electric vehicle manufacturer VinFast, meanwhile, said it is always open to collaborating with potential strategic partners in India. “Several experienced local suppliers have already reached out to us with partnership proposals, which we are currently reviewing," said its India CEO Tapan Kumar Ghosh. A spokesperson for Skoda Auto Volkswagen India said India is a key market in Škoda Auto’s internationalisation plans. “To fully explore the country’s growth potential, we are always considering new business opportunities and are evaluating various options to ensure the best possible solution to implement our strategy in the highly dynamic Indian market.” Skoda Auto Volkswagen India and Mahindra had explored a partnership, but the talks have now stalled. Companies such as Renault and Geely did not comment on potential plans for a partnership. Industry sources said exploratory talks were taking place quietly.

To achieve sustainable growth, automakers in India must collaborate and form strategic partnerships, said Kavan Mukhtyar, leader automotive at PwC India. “With technology becoming increasingly disruptive, the need for significant investment and profitable expansion is driving automakers to actively explore alliances and joint ventures,” he said. Ravi Bhatia, president of automobile consultancy Jato Dynamics, said local support will help foreign automakers scale operations as well as cut costs. “Renault with its underutilised Chennai plant (33% capacity) boasts modular architecture, but needs partners to scale exports and leverage India's 50% localisation mandates for duty cuts,” he said. “Strategic partnerships could bridge gaps, cutting EV costs by 15-20%.”

However, experts caution that local tie-ups are no guarantee of success. Past alliances such as Mahindra-Ford and Premier Automobiles-Peugeot underscore the risks of mismatched strategies and governance issues. “Partnerships only work when both sides bring more than money; they need long-term commitment and strategic alignment,” said an auto industry veteran. “Many earlier JVs failed because the foreign partner saw India as an export base, not a domestic growth story.”

For now, several global automakers are leaning on exports from their Indian plants to stay viable, even as their domestic market share remains marginal. With India’s position in the global automobile market continuing to grow, analysts believe localisation in manufacturing, products and management will determine who thrives. “India rewards long-term commitment,” said an analyst. “Without it, even the biggest global brands will remain on the fringes.”

You may also like

AP: Kurnool Police identify biker, pillion rider involved in bus accident

Princess Beatrice and Eugenie's 'true feelings' about royals after Andrew scandal - expert

Royal Family RECAP: Meghan Markle slammed after 'rude' moment on stage - 'So awkward'

Reform MP apologises after saying 'adverts full of black people, full of Asian people'

Tottenham boss Thomas Frank debunks Micky van de Ven worry amid relentless fixture churn